Bethany McLean

Born: Hibbing, Minnesota on December 12, 1970

Connection to Illinois: McLean resides in Chicago. She also serves on the board of the Stigler Center at the University of Chicago. Biography: Bethany McLean is a journalist and contributing editor for Vanity Fair. She is also a columnist at Yahoo Finance and a contributor to CNBC. Her two books are the The Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron and All the Devils Are Here: The Hidden History of the Financial Crisis. She has also written two mini books, Shaky Ground: The Strange Saga of the US Mortgage Giants and Saudi America: The Truth About Fracking and How It's Changing the World. She's a 1992 graduate of Williams College.

Awards:

LinkedIn: https://www.linkedin.com/in/bethany-mclean-5a728?original_referer=https%3A%2F%2Fwww.bing.com%2F

Twitter: https://twitter.com/bethanymac12

Web: https://www.vanityfair.com/contributor/bethany-mclean

Wikipedia: https://en.wikipedia.org/wiki/Bethany_McLean

WorldCat: http://www.worldcat.org/search?q=Bethany++McLean

Selected Titles

|

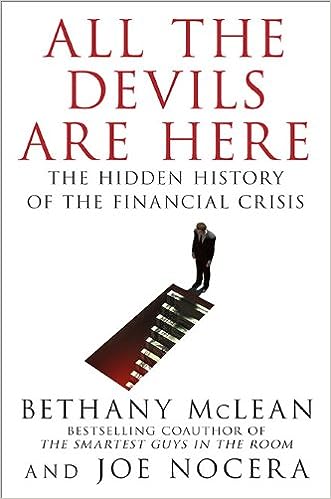

All the Devils Are Here: The Hidden History of the Financial Crisis ISBN: 1591843634 OCLC: 535490487 Portfolio New York : 2010 "Hell is empty, and all the devils are here."--Shakespeare, The Tempest As soon as the financial crisis erupted, the finger-pointing began. Should the blame fall on Wall Street, Main Street, or Pennsylvania Avenue? On greedy traders, misguided regulators, sleazy subprime companies, cowardly legislators, or clueless home buyers? According to Bethany McLean and Joe Nocera, two of America's most acclaimed business journalists, the real answer is all of the above-and more. Many devils helped bring hell to the economy. And the full story, in all of its complexity and detail, is like the legend of the blind men and the elephant. Almost everyone has missed the big picture. Almost no one has put all the pieces together. All the Devils Are Here goes back several decades to weave the hidden history of the financial crisis in a way no previous book has done. It explores the motivations of everyone from famous CEOs, cabinet secretaries, and politicians to anonymous lenders, borrowers, analysts, and Wall Street traders. It delves into the powerful American mythology of homeownership. And it proves that the crisis ultimately wasn't about finance at all; it was about human nature. Among the devils you'll meet in vivid detail: • Angelo Mozilo, the CEO of Countrywide, who dreamed of spreading homeownership to the masses, only to succumb to the peer pressure-and the outsized profits-of the sleaziest subprime lending. • Roland Arnall, a respected philanthropist and diplomat, who made his fortune building Ameriquest, a subprime lending empire that relied on blatantly deceptive lending practices. • Hank Greenberg, who built AIG into a Rube Goldberg contraption with an undeserved triple-A rating, and who ran it so tightly that he was the only one who knew where all the bodies were buried. • Stan O'Neal of Merrill Lynch, aloof and suspicious, who suffered from "Goldman envy" and drove a proud old firm into the ground by promoting cronies and pushing out his smartest lieutenants. • Lloyd Blankfein, who helped turn Goldman Sachs from a culture that famously put clients first to one that made clients secondary to its own bottom line. • Franklin Raines of Fannie Mae, who (like his predecessors) bullied regulators into submission and let his firm drift away from its original, noble mission. • Brian Clarkson of Moody's, who aggressively pushed to increase his rating agency's market share and stock price, at the cost of its integrity. • Alan Greenspan, the legendary maestro of the Federal Reserve, who ignored the evidence of a growing housing bubble and turned a blind eye to the lending practices that ultimately brought down Wall Street-and inflicted enormous pain on the country. |

|

Nollywood: The Strange Saga of the U.S. Mortgage Giants ISBN: 0990976300 OCLC: 898533197 Columbia Global Reports 2015 Fannie Mae and Freddie Mac were created by Congress to serve the American Dream of homeownership. By the end of the century, they had become extremely profitable and powerful companies, instrumental in putting millions of Americans in their homes. So why does the government now want them dead? In 2008, the U.S. Treasury put Fannie and Freddie into a life-support state known as “conservatorship” to prevent their failure―and worldwide economic chaos. The two companies, which were always controversial, have become a battleground. Today, Fannie and Freddie are profitable again but still in conservatorship. Their profits are being redirected toward reducing the federal deficit, which leaves them with no buffer should they suffer losses again. China and Japan are big owners of Fannie and Freddie securities, and they want to ensure the safety of their investments―which helps explain why the government is at an impasse about what to do. But the current state of limbo is unsustainable. Based on comprehensive reporting and dozens of interviews, Shaky Ground chronicles the story of Fannie and Freddie seven years after the meltdown, and tells us why homeownership finance is now one of the biggest unsolved issues in today's global economy―and why it must be placed on firmer ground. |

|

Saudi America: The Truth About Fracking and How It's Changing the World ISBN: 0999745441 OCLC: 1028187397 Columbia Global Reports 2018 The true story of fracking’s impact—on Wall Street, the economy and geopolitics The technology of fracking in shale rock—particularly in the Permian Basin in Texas—has transformed America into the world's top producer of both oil and natural gas. The U.S. is expected to be “energy independent” and a “net exporter” in less than a decade, a move that will upend global politics, destabilize Saudi Arabia, crush Russia's chokehold over Europe, and finally bolster American power again. Or will it? Investigative journalist Bethany McLean digs deep into the cycles of boom and bust that have plagued the American oil industry for the past decade, from the financial wizardry and mysterious death of fracking pioneer Aubrey McClendon, to the investors who are questioning the very economics of shale itself. McLean finds that fracking is a business built on attracting ever-more gigantic amounts of capital investment, while promises of huge returns have yet to bear out. Saudi America tells a remarkable story that will persuade you to think about the power of oil in a new way. |

|

Smartest Guys in the Room: The Amazing Rise and Scandalous Fall of Enron ISBN: B000EUKRC2 OCLC: Portfolio 2003 An account of the rise and fall of Enron, written by award-winning Fortune investigative reporters, draws on a wide range of sources while revealing the contributions of lesser-known participants in the scandal. |

|

The Big Fail: What the Pandemic Revealed About Who America Protects and Who It Leaves Behind ISBN: 0593331028 OCLC: 1365362764 Portfolio 2023 From the collaborators behind the modern business classic All the Devils are Here comes a damning indictment of American capitalism—and the leaders that left us brutally unprepared for a global pandemic In 2020, the novel coronavirus pandemic made it painfully clear that the U.S. could not adequately protect its citizens. Millions of Americans suffered—and over a million died—in less than two years, while government officials blundered; prize-winning economists overlooked devastating trade-offs; and elites escaped to isolated retreats, unaffected by and even profiting from the pandemic. Why and how did America, in a catastrophically enormous failure, become the world leader in COVID deaths? In this page-turning economic, political, and financial history, veteran journalists Bethany McLean and Joe Nocera offer fresh and provocative answers. With laser-sharp analysis and deep sourcing, they investigate both what really happened when governments ran out of PPE due to snarled supply chains and the shock to the financial system when the world's biggest economy stumbled. They zero in on the effectiveness of wildly polarized approaches, with governors Andrew Cuomo of New York and Ron DeSantis of Florida taking infamous turns in the spotlight. And they trace why thousands died in hollowed-out hospital systems and nursing homes run by private equity firms to “maximize shareholder value." In the tradition of the authors’ previous landmark exposés, The Big Fail is an expansive, insightful account on what the pandemic did to the economy and how American capitalism has jumped the rails—and is essential reading to understand where we’re going next. |